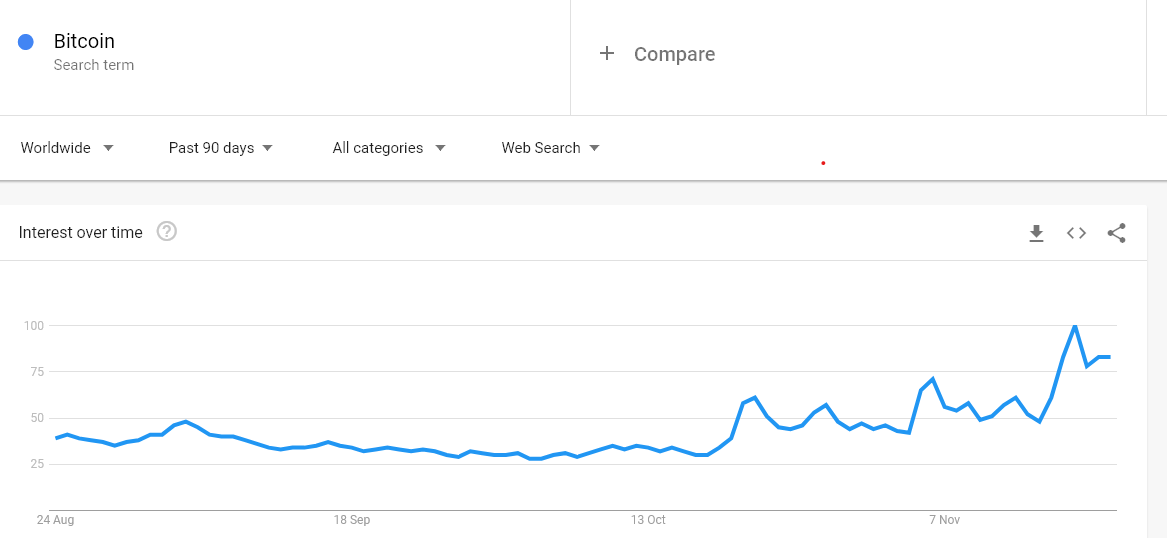

Bitcoin has just reached a 2020 peak of $19,000 USD, a price not seen since the last bull market of 2018. Earlier in March, Bitcoin was $4000 USD – since then it has climbed 375%. As prices approach previous all-time highs there is renewed interest in Bitcoin and the entire crypto asset class. The price action might be shocking for those new to the story, but the big picture remains interesting for Bitcoin and cryptocurrency.

What is Bitcoin?

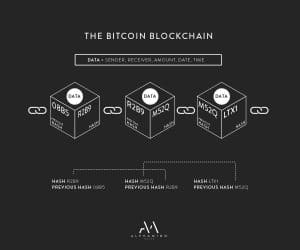

Bitcoin is a new technology, a scarce digital commodity, and for some it is money. Here is the original whitepaper from 2008/09: https://bitcoin.org/bitcoin.pdf . I suggest everyone read the whitepaper at some point despite the lofty technical elements. Bitcoin is essentially a decentralized network of computers all over the world which communicate with each other to verify and validate a ledger of transactions which is established with cryptographic hash functions. Each node contains an entire copy of the global ledger which means that to take down the Bitcoin network, you in theory have to eradicate every single node. It was released to the world by an anonymous pseudonym called “Satoshi Nakamoto” which may have been either an individual or group of people. The true identity of Satoshi remains unknown.

Bitcoin is presumed to be a reaction to the great financial collapse of 2008 and the role of large centralized banks in facilitating it. The following message was left in the “genesis block” of the network by Satoshi: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” By creating a purely electronic, peer to peer, and trustless payments network an alternative would be available to the banking system which has so greatly mismanaged assets and trust. Most importantly, Bitcoin is fully public and open source, meaning anybody can access it, use it and build on it.

Why Does it Matter?

Bitcoin truly is something new – nothing like it ever really existed before. Some of the component technologies like blockchain and cryptographic hashes were already around, but Bitcoin is a novel application of these to create a disintermediated, decentralized electronic payments network. It has interesting properties which set it apart from almost any other asset. One important consideration is that Bitcoin came to be purely through free market forces – people choose to use it and regard it as valuable; there is no government or authority to compel anyone. In having no central point of failure to attack or undermine it is also extremely resilient to statist intervention.

From Bitcoin came Ethereum and many other smaller cryptocurrencies which now number in the thousands. In the cryptocurrency ecosystem Bitcoin is the default reserve currency – it is actively used as a store of value, a medium of exchange and a unit of account (prices are measured in BTC fractional units called “satoshis”). In fact, Bitcoin has all of the properties of “sound money” or rather money which is resistant to debasement by central banks or governments. These properties apply to gold and were originally outlined by Aristotle; a good money should possess the following qualities:

- Durable (not easily destroyed)

- Portable (easy to store and transport)

- Divisible (able to break into smaller units)

- Fungible / Uniform (consistency between one unit and another)

- Rarity / Scarcity (not widely abundant or easily created)

- Valuable (people need to regard it as valuable)

In fact, if we compare Bitcoin to the most endearing money in history (gold) we find that Bitcoin is superior as money in a few ways:

- There are no “Bitcoins” to destroy – the network is ledger entries

- Can be beamed anywhere in the world and high values carried in a pocket

- Infinitely divisible – can be broken into fractional units much smaller than gold grams

- Every BTC is the same and consistent vs. varying grades, purities, etc.

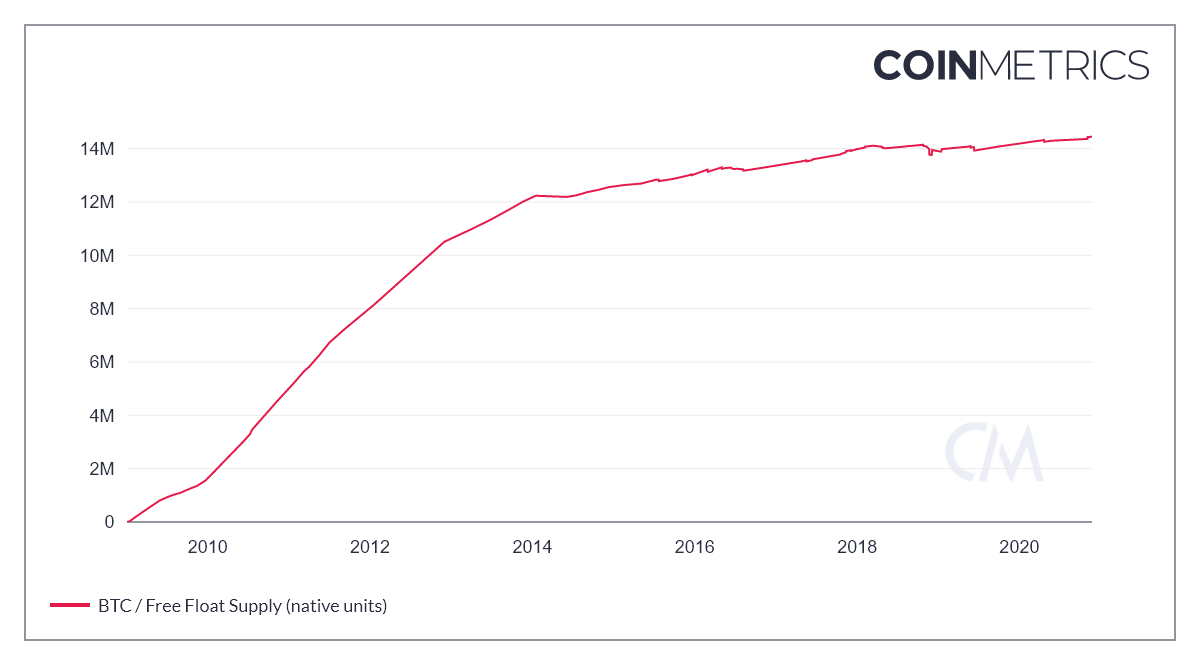

- Higher scarcity than gold; higher stock to flow ratio by 2024 and 21 million hard cap supply

- Value as payment and transfer network

- Does not require centralized vaulting in a particular jurisdiction

Bitcoin is money that can be privately held on a decentralized global network. If you own your private key, the code to access your ledger entries, then you own your assets with no counterparty risk. This is not the case when you hold your money deposited in a bank account as an unsecured liability. Accomplished hedge fund manager Raoul Pal has called Bitcoin “pristine collateral” and feels it is the best collateral, reserve asset available. The network also runs 24/7 and has seen no down time since inception.

Still Early Days

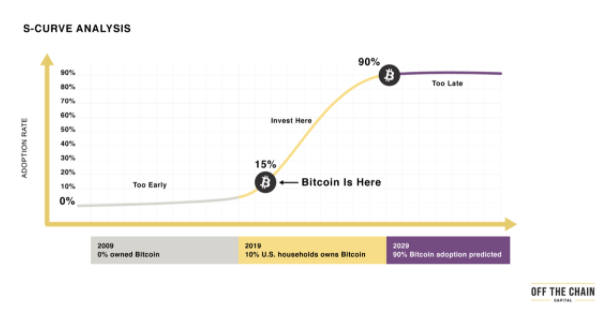

Early Bitcoin adopters are infamous for their gains so far; early investors were able to purchase Bitcoin for as little as $0.06 USD, which would turn $100 into $31,500,000 at today’s prices. However, many still do not realize that over those ten years or so Bitcoin adoption went from 0% to just 10%. S-curve analysis implies that the amount of time it takes for a new technology to go from 0% adoption to 10% is the same amount of time required to go from 10% to 90%. This suggests that Bitcoin could move towards 90% adoption by 2030. When an asset has a fixed supply and increasing demand price has no choice but to increase.

2020: The Year Money Printing Blows Up

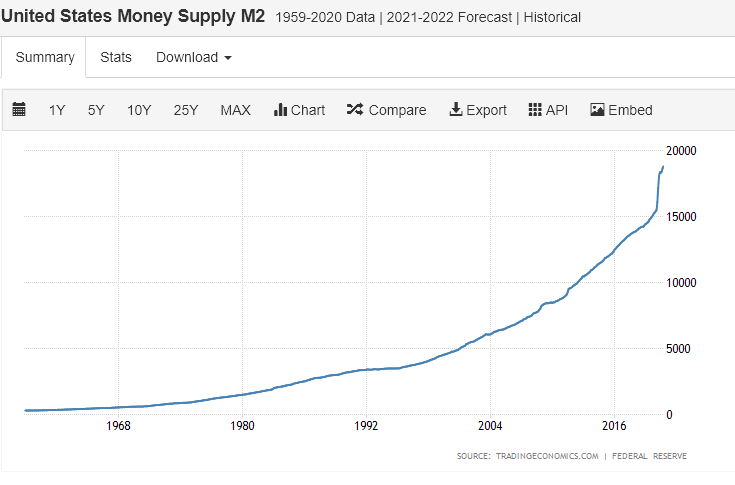

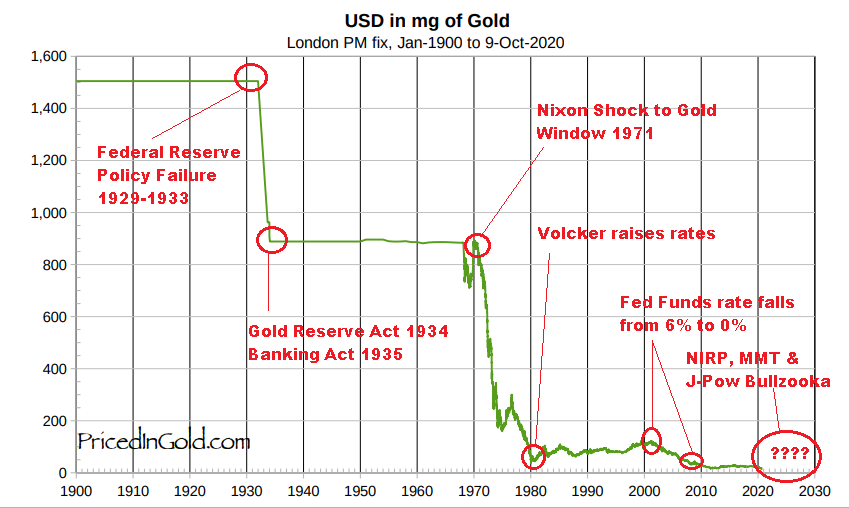

The US dollar, the reserve currency of the world, has been on a downwards spiral in purchasing power since 1933. This accelerated dramatically in 1971 when President Nixon suspended the conversion of USD into gold by the treasury. This effectively made the USD backed by nothing except pure debt and allowed the government and banks to dramatically expand the money supply, effectively debasing the purchasing power of dollars:

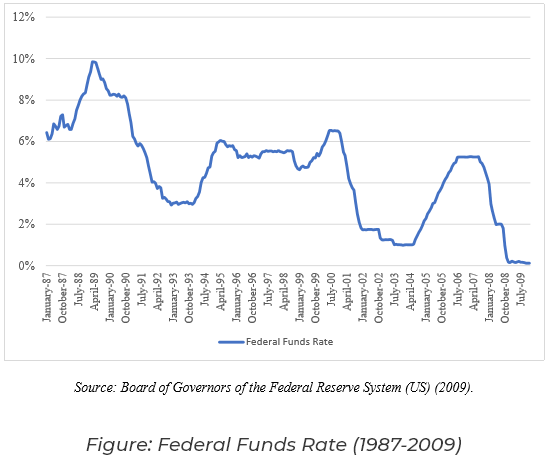

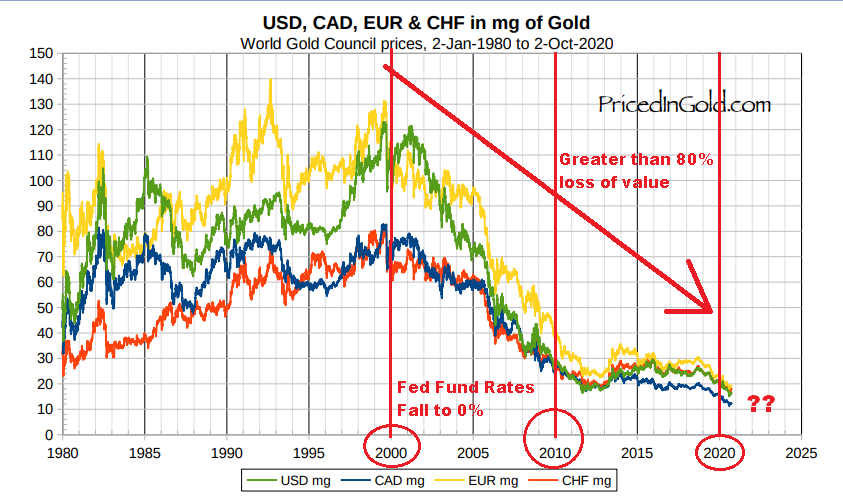

Due to the radical expansion of the debt and abuse of leverage, interest rates had to be dramatically cut around 2000-2001 which further amplified this effect. Most major currencies lost 80%+ of their purchasing power in real terms from the years 2000-2020:

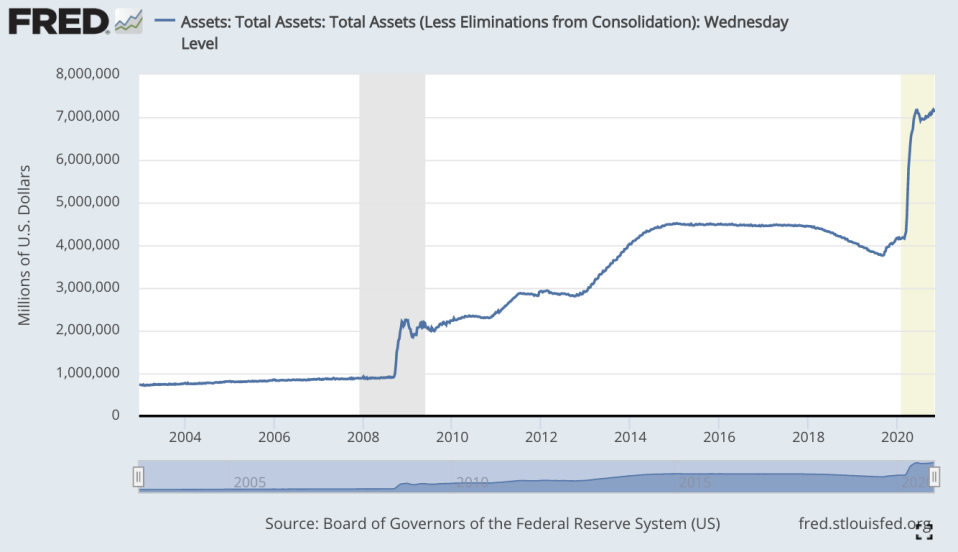

In response to covid19, money printing (via debt expansion) has gone parabolic in 2020 with the trend expected to continue for the foreseeable future – the Federal Reserve has openly stated they do not plan to raise rates until 2023 or beyond:

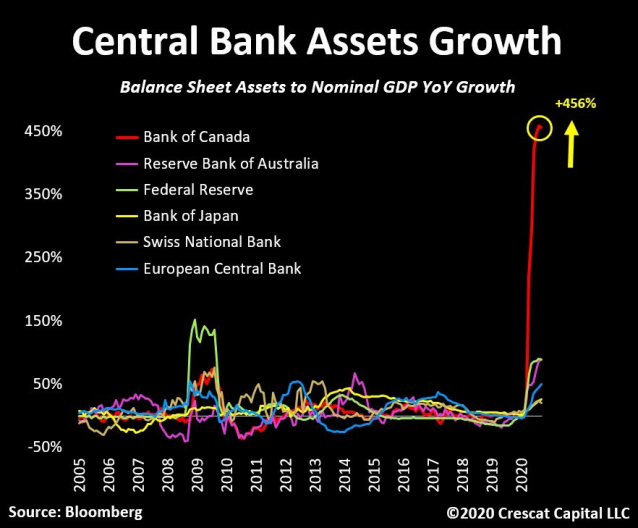

In Canada, we have actually done worse:

Bitcoin is the Toll Booth to the Cryptoverse

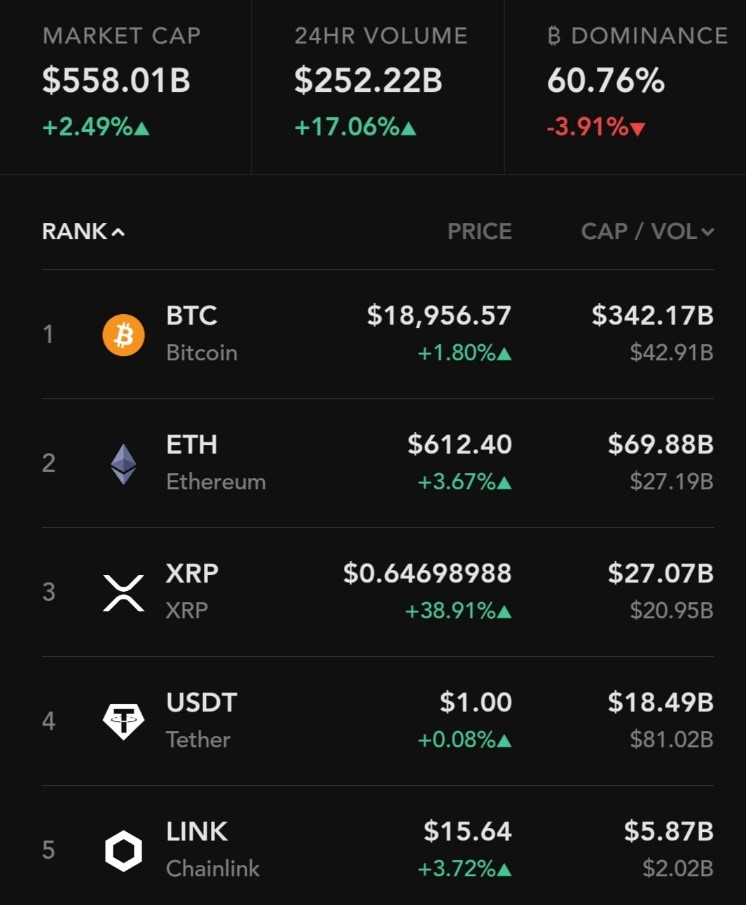

As the native reserve currency of the ecosystem and with the largest market cap, Bitcoin tends to be the onboarding ramp for all other digital assets. In order to purchase many smaller coins through cryptocurrency exchanges you must convert funds into Bitcoin first. It also still commands the majority of market dominance as the first mover:

Although at $340B there are only 12 companies larger than Bitcoin in the world, the relative market capitalization is still insignificant compared to capital pools like gold, USD or bonds. If Bitcoin could capture 10% of the alternatives market it would rise to over $1 Trillion in market capitalization. With low rates destroying yields and debt expansion ravaging currencies, money will be looking for a safe haven and Bitcoin might be considered a possible alternative. This does not even begin to touch on the massive, disruptive potential of other crypto projects such as Ethereum or Stellar Lumens. The disruptive applications of crypto technology are numerous: https://academy.binance.com/en/articles/blockchain-use-cases .

Catalysts Moving Forward

Inflation / currency debasement: With debt to GDP ratios of 135% in the United States it is mathematically impossible to pay down their debt or raise rates; it seems likely that debt expansion and currency debasement will continue as a way to quietly pay down the debt. This puts any assets priced against dollars at an advantage.

Institutional Money: Larger institutions are beginning to enter the cryptocurrency space which will provide necessary capital for continued development along with brand recognition and credibility to help foster mass adoption. The value of cryptocurrency networks grows primarily through the network effect aka Metcalfe’s law. Put simply, the more people use it the more valuable it becomes. With names such as Fidelity, Visa, Microsoft, PayPal, and Grayscale entering the space it marks a notable shift in sentiment from a few short years ago. Larger conventional institutions also help provide the necessary bridge in infrastructure to bring more people into the space via traditional brokerages and payment platforms. For example, PayPal has 305 million active accounts in 202 markets and supports 25 currencies globally – by offering cryptocurrencies they dramatically expand the market scope.

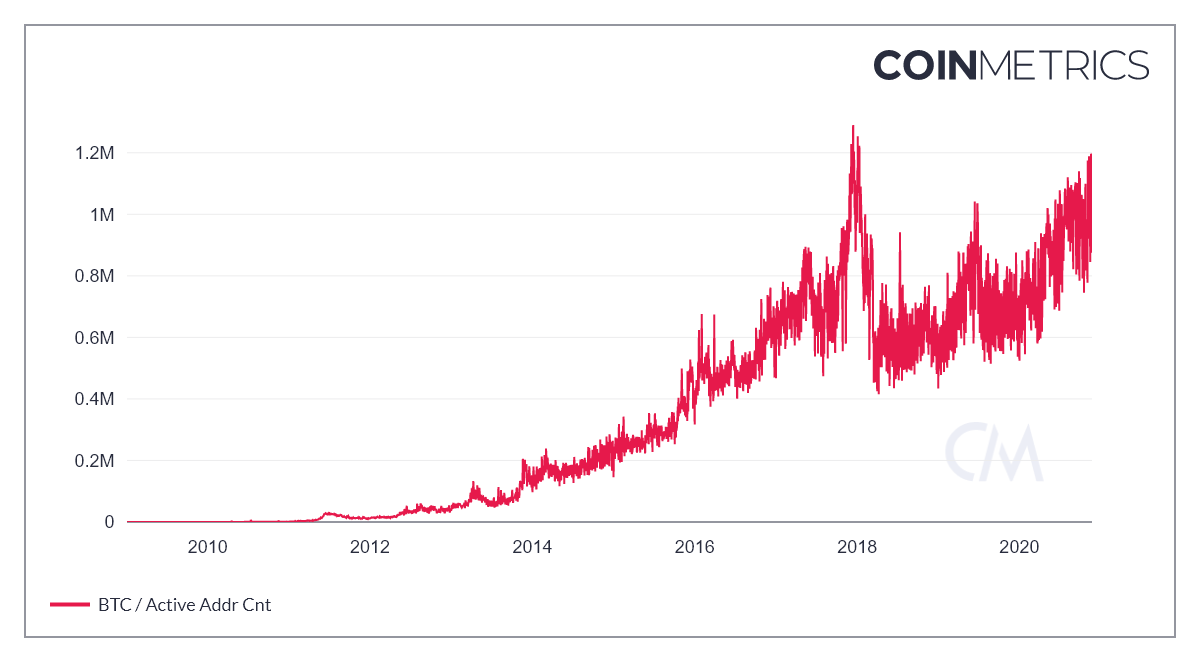

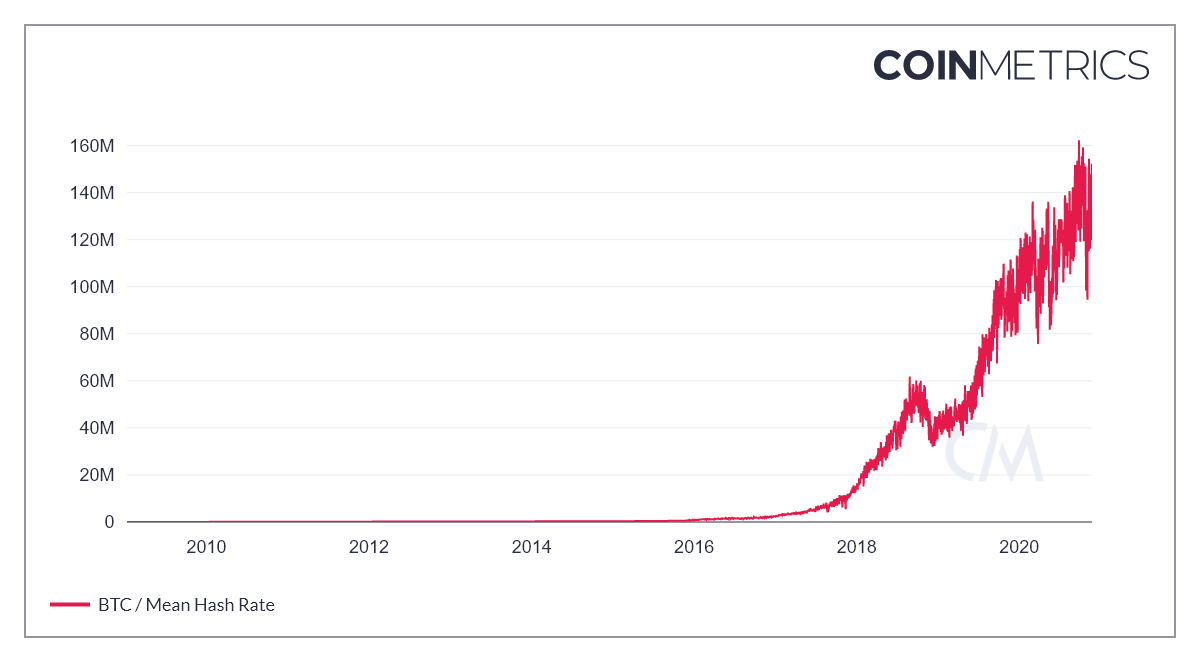

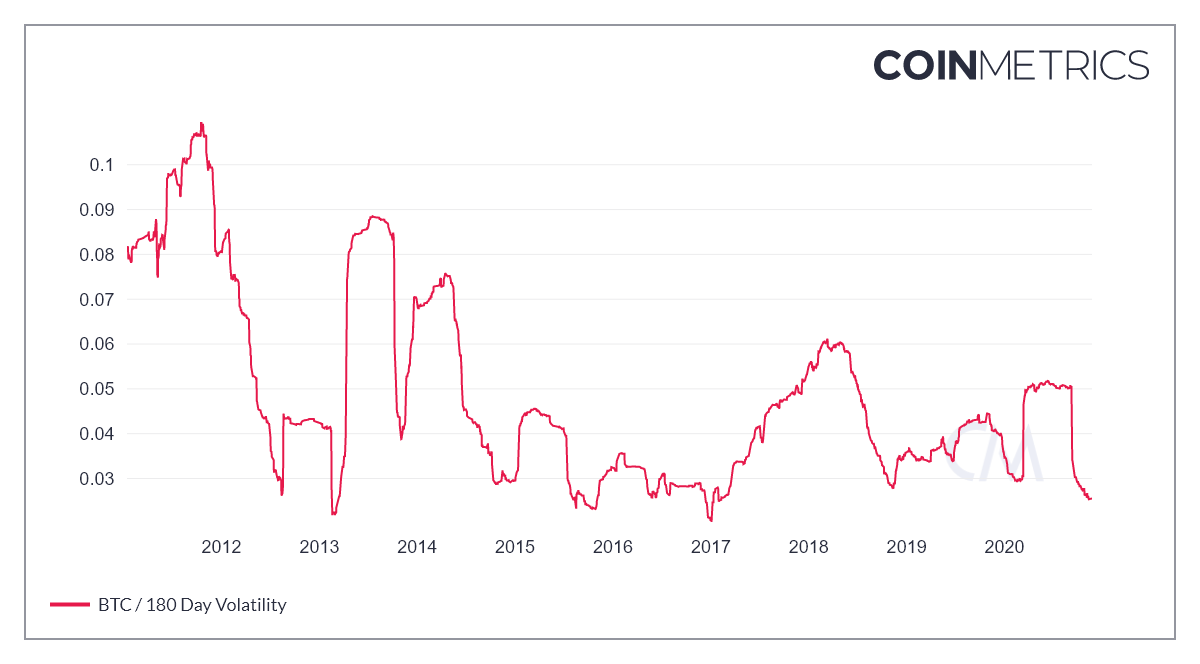

Improving network fundamentals: The BTC network continues to be arguably the most robust cryptocurrency network on earth with real use increasing. Active address counts and hash rates (mining computing power) continue to grow:

Outstanding Technical Performance: Bitcoin has turned heads with outperformance on a technical price level. It has trended well above 200 day moving averages and produced 1-year ROIs of 150%. Ethereum has outperformed Bitcoin. When previous all-time highs break price discovery should take effect:

The cryptocurrency ecosystem has made large strides in fundamental development since the last bear market and prices are beginning to play catch up. With macroeconomic policy providing strong tailwinds and an increasingly digital post-covid world I suspect that existing trends will persist and accelerate. There has never been a more interesting time to get involved as either a developer or market participant. As larger flows of capital move into the asset class they should affect the largest market capitalization assets first, such as Bitcoin and Ethereum, eventually finding their way to smaller coins. New financial instruments like ETFs and derivatives are likely to follow along with a whole new spectrum of decentralized financial services. Capital attracts more capital like a magnet and as more money flows into crypto assets mass adoption may become a self-fulfilling prophecy.

If you are interested in purchasing Bitcoin or other crypto assets I suggest you speak with your trusted investment professional immediately.

Disclaimer: Brendan Valentine is not a broker or registered investment advisor and as such does not offer or provide personalized advice. The information provided is not intended to be, and should not be construed in any manner whatsoever as personalized advice or as Brendan Valentine’s solicitation to effect, or attempt to effect, any transaction in a security. All investments involve substantial risk and the information provided should not be a substitute for advice from an investment professional. Please obtain personal advice from your professional investment advisor and make independent investigations before acting on the information that you obtain from Brendan Valentine. Only you can determine what level of risk is appropriate for you.

The trading strategies discussed may be unsuitable for you depending upon your specific investment objectives and financial position. You must make your own investment decisions in light of your own investment objectives, risk profile, and circumstances. Use independent advisors, as you believe necessary. Therefore, the information provided herein is not intended to be specific advice as to whether you should engage in a particular trading strategy or buy, sell, or hold any financial product. Margin requirements, tax considerations, commissions, and other transaction costs may significantly affect the economic consequences of the trading strategies or transactions discussed and you should review such requirements with your own legal, tax and financial advisors. Before engaging in such trading activities, you should understand the nature and extent of your rights and obligations and be aware of the risks involved.

Your actions and the results of your actions in regard to anything you receive from Brendan Valentine is entirely your own responsibility. Brendan Valentine cannot and will not assume liability for any losses that may be incurred by the use of any information received from Brendan Valentine. Any such liability is hereby expressly disclaimed.