HABIT 005: Collect Flight & Hotel Points

The worst thing about travel is it costs money. Most times a lot of it.

Flights and Hotels are often 50-75% of the overall travel budget. What if there was a way to wipe out a huge portion of those costs? This would take a travel budget so much further.

The process of “travel hacking” can be broken down into some simple steps.

Earn & Burn

Most people think about swiping their loyalty credit card at the grocery store, or some Expedia based card. This is the slow and ineffective way to do this. Most cards will reward about 1 mile per dollar spent. Which means redeeming a flight from say North America to Europe would take about 60 000 miles with an economy ticket. How long would it take to spend $60 000 for that ticket?

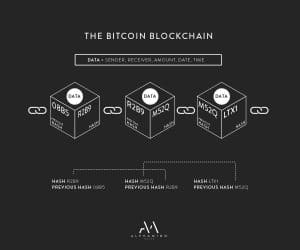

Credit Card companies give you huge rewards just for opening cards and hitting minimum spend limits over x amount of time. This means that these offers can be redeemed and the cards can be cancelled after the points are used before a renewal fee on the card comes up the following year. The best part is that most of these points are transferable into other points plans such as Air Canada’s Aeroplan. Most Airlines offer 1:1 point transfers from major credit card providers so they can act as a nice “bank” for stacking points from cards.

The Value

A business class flight from North America to Asia would cost in the ballpark of $5500+.

An economy class flight from North America to Asian would cost in the ballpark of $1000+.

An economy class flight from North America to Asian would cost in the ballpark of $1000+.

For a cash purchase, the business class flight ends up costing 5 times the price of an economy flight.

That same business class flight can be redeemed for around 150 000 points from an airline travel program or 75 000 points for the economy flight. Meaning business class can be had at just 2 times the value of economy redemption versus 5 times the value of a cash redemption.

There are credit cards which give 75 000 points in just 1 signup.

2 card sign ups = 150 000 points.

Even with annual card fees, It’s basically like getting a business class flight from North America to Asia for $1000. A similar process can be used for hotel points with major hotel providers.

Have a Plan

Do you want less stays in really nice hotels or more stays in average hotels?

Do you want more flights to more places or fewer flights in style?

Do you know where you are planning to travel to or where you would like to stay?

Having a plan makes it a lot easier to figure which travel plan or hotel points program to use in order to achieve the goal. Use only the cards needed to hit the minimum spend bonuses and avoid cash as much as possible on all purchases.

If you work for a company that includes travel, offer to use your own travel card to incur the expense and get reimbursed later. Out with friends for a good time? Pay for the meal and take cash from everyone.

Can I use my points on any flights I want?

Research which airline or hotel points plan offers destinations you plan to travel to or offers the most flexibility in destinations during planning for the best redemption opportunities. Find programs that have alliances with many other programs.

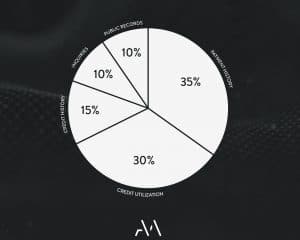

Won’t this affect my credit score?

Contrary to popular belief, this activity can actually improve credit score as long as the tips are followed from the AlphaMind credit card usage post ‘ HABIT 004: Build Credit, Not Debt ’. Smart card use is the key to maintaining a healthy credit score. After cancelling a card and redeeming points, make sure not to apply for that card again for at least 6 months to improve the chances of getting approved for that card in the future.

Every time you apply for a new credit card, your score does take a small 2- to 5-point hit. But that dip is temporary and, in the long run, you’ll likely benefit from the lower utilization rate these additional credit lines can generate.

Why do this?

The rewards and cost savings far outweigh the efforts required for most people. While it isn’t completely free travel, it’s heavily discounted travel subsidized by the airlines and credit card company marketing divisions.

Warning

You should be very financially responsible to do this effectively. Maintain a secured spreadsheet with card details and login details of various point programs to ensure everything is in order. Credit card debt is a huge problem. Avoid interest fees for this to be effective. It’s a wise idea to avoid this process all together if having too many credit cards will be too much of a temptation for unnecessary spending.

Disclaimer – This information is for entertainment purposes only. The writer of this content is not an investment advisor, financial planner, nor legal or tax professional and articles here are of an opinion and general nature and should not be relied upon for individual circumstances.